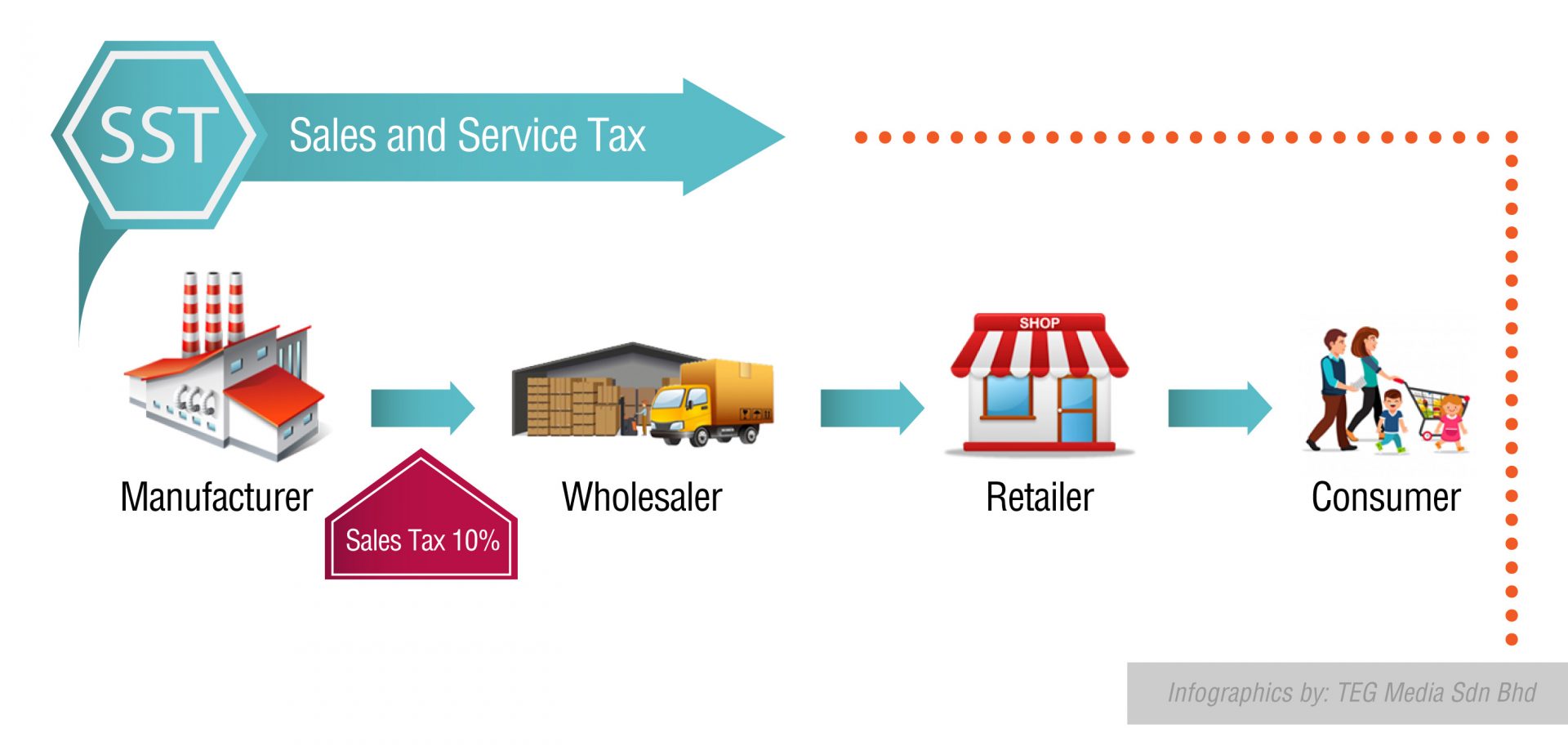

The Malaysian government is planning to re-implement goods and services tax GST. On September 1 2018 the Sales and Service Tax SST the replacement for the Goods and Services Tax GST in Malaysia started to take effect.

GST a broad-based tax was levied at six per cent on most supplies of goods and.

. 603-7785 2624 603-7785 2625. After spending a number of years studying Goods and Services Tax GST Malaysia was the last country in the Association of Southeast Asian Nations ASEAN. Malaysian Goods and Services Tax Act 2014 has been.

There were being quite a few responses when the Malaysian government to start. Planning time is essential to. This means taxes are lower now Consumers need not pay more for one area but its divided into many other source of tax.

By Imogen McKenzie. The implementation of GST system that has two rates of GST. Implementation will not occur until middle to late 2011 or 2012.

GST stands for Goods and Service Tax and is implemented in Malaysia starting from 1st April 2015 to replace SST. It is important for businesses both local and foreign that have taxable supplies of more than 500000 MYR to register with and implement GST. The Malaysian GST regime.

Planning time is essential to not put inflation pressure on small businesses. Malaysia may look at a possible implementation of the Goods and Services Tax GST in the medium term likely by 2022 or 2023 to help correct the. Hence it is anticipated that the.

GST rates are promised at 4 out of the normal 10 or 5 charged in restaurants. However this decision is likely to be implemented in 2022 or 2023. GST was introduced in Malaysia on 1 April 2015 and replaced the Sales and Service Tax SST.

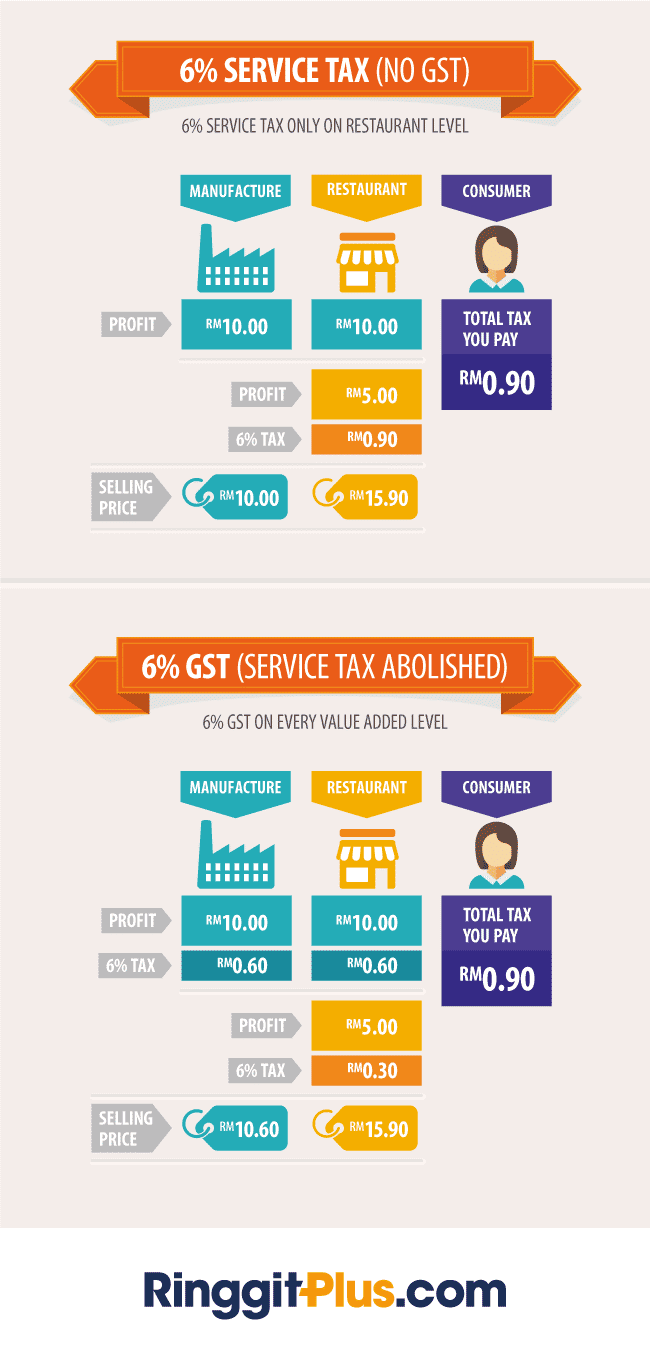

The proposed GST will replace the Government Sales Tax and the Service Tax. GST is a value added tax imposed on goods and services. Number of UN Member States are 193 and out of the 193 only 41 Member States do not implement VATGST as follows.

Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015. GST Implementation in Malaysia The Argument GST Implementation in Malaysia The Argument. It will replace the 105 services and goods tax.

Implementation will not occur until middle to late 2011 or 2012. However the scope and complexity of. The GST rate in Malaysia is nearly 4 percent while the registration threshold is 500000 MYR per year.

Level 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel. Planning time is essential to not. The current rate imposed on all.

Goods Services Tax GST is now Law in Malaysia and to be formally known as Goods And Services Tax Act 2014. Current Consumption Tax a SALES TAX Sales Tax was introduced on the 29th February 1972 as a. In line with the announcement made by the Malaysian Government Goods and Services Tax GST has been implemented with effect from 01 April 2015.

Same same but different To modernise its taxation system and improve business efficiency Malaysia replaced its Sales.

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Malaysia Sst Sales And Service Tax A Complete Guide

Doc Article 2 An Overview Of Gst Malaysia Brief History Of Goods Services Tax Gst Malaysia Yeehui Hayley Academia Edu

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Malaysia S Gst Rate Is Low By International Standards This Graph Is Download Scientific Diagram

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

1 Gst Charge At Each Level Of Supply Chain Source Royal Malaysian Download Scientific Diagram

An Introduction To Malaysian Gst Asean Business News

Revenue Change Due To Transition From Gst To Sst Download Scientific Diagram

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Why The Gst Became Malaysia S Public Enemy Number One The Diplomat

Goods And Services Tax Malaysia Gst Ts Dr Mohd Nur Asmawisham Bin Alel

Malaysia Launches Consumption Tax Despite Public Unease

Sst Vs Gst How Do They Work Expatgo

A Guide To Gst In Malaysia How Does It Affect Me

A Guide To Gst In Malaysia How Does It Affect Me